Local News and Information Archives for 2015-03

New and Existing Home Sales Increase in February

Builders signed contracts on more homes last month than any time since early 2008, according to figures released by the Census Bureau and HUD. February seasonally adjusted annual new home sales topped out at a 539,000 annual pace, up 7.8% from a healthy 500,000 rate in January.

Builders signed contracts on more homes last month than any time since early 2008, according to figures released by the Census Bureau and HUD. February seasonally adjusted annual new home sales topped out at a 539,000 annual pace, up 7.8% from a healthy 500,000 rate in January.

In percentage terms, sales increased the most in the Northeast (153% over the January rate) due to earlier weather-related declines. Inventories dropped slightly to 210,000, which, with the increased sales rate, lowered the months’ supply measure to 4.7 months. Lower inventories suggests optimism about construction growth for the year ahead.

Although reporting smaller gains, existing home sales shook off winter-related declines in February as well. As reported by the National Association of Realtors, sales increased 1.2% in February (up 4.7% from a year earlier), and the share of sales for first-time buyers registered its first gain since last November. Supplies of existing homes for sale are also diminished, with the current inventory representing only a 4.6-month supply.

In percentage terms, sales increased the most in the Northeast (153% over the January rate) due to earlier weather-related declines. Inventories dropped slightly to 210,000, which, with the increased sales rate, lowered the months’ supply measure to 4.7 months. Lower inventories suggests optimism about construction growth for the year ahead.

Although reporting smaller gains, existing home sales shook off winter-related declines in February as well. As reported by the National Association of Realtors, sales increased 1.2% in February (up 4.7% from a year earlier), and the share of sales for first-time buyers registered its first gain since last November. Supplies of existing homes for sale are also diminished, with the current inventory representing only a 4.6-month supply.

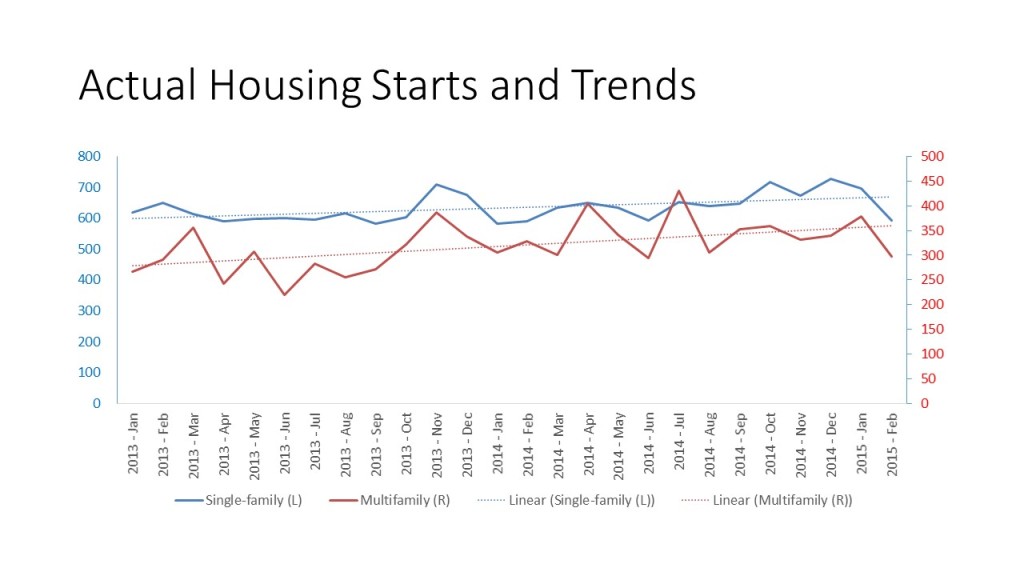

However, the lingering regional effects of the tough winter for the Eastern part of the U.S. were seen in disappointing construction data for February. The pace of housing starts fell 17% to its lowest level since January 2014.

The decline was across the board in building types and regions. Single-family starts were down 14.9% and multifamily starts fell 20.8%. Single-family starts decreased the most in the weather sensitive Northeast (-60.7%) and Midwest (-32.4%) but were also down in the less weather affected South (-5.9%) and West (-9.1%).

The declines mirror the NAHB/Wells Housing Market Index (HMI), which fell two points to 53 in March. The drop marked the third consecutive decrease in this measure of single-family builder confidence.

However, the HMI has been above 50 since July of last year, suggesting that the outlook for construction growth is good, not great. Similarly, fourth-quarter market data from the Census Bureau and HUD Survey of Market Absorption of Apartments suggest ongoing strong rental demand and positive prospects for maintaining current levels of multifamily development.

5 Quick Tips for Managing OSHA’s New Recordkeeping Requirements

When responding to OSHA’s requests for information per the updated recordkeeping rule, make sure to keep these tips in mind:

-

State the known facts, not opinions or speculation. Speculation or opinions, particularly as to the cause of an accident or the existence of a hazard, are often misinterpreted as admissions as to what actually happened. For example, if cause is only suspected or unknown, or if the instance is still under investigation, say so.

-

Avoid placing blame or admitting legal violations. Statements that supervisors violated company rules or committed OSHA violations can significantly impact your company’s liability.

-

If a problem is noted, always follow up and document that corrective action has been taken. Almost all safety investigation forms have a space to note recommended or completed corrective action. Failure to take corrective action may be construed by OSHA as willful conduct.

-

Be truthful. A false statement in any safety documentation can be very damaging. Make certain that all information provided to OSHA is carefully reviewed and, if necessary, corrected for accuracy.

When in doubt, especially with regard to fatality, catastrophic accident or other significant cases, get the advice of legal counsel before responding with anything more than what you are required by law to initially report

Housing Production Stumbles

Housing starts fell 17% to their lowest level since January 2014. The decline was across the board in building types and regions. Single-family starts were down 14.9% and multifamily starts were down 20.8%. Single-family starts were down the most in the weather sensitive Northeast (-60.7%) and Midwest (-32.4%) but were also down in the less unseasonable weather patterns of the South (-5.9%) and West (-9.1%).

While total building permits were up 3%, single-family permits were down 6.2% with only the West recording a rise in single-family permits (+5.6%). Multifamily permits were up 18.3% to the highest level since April 2014 and only the third time above 470 since 2006.

Aside from a small weather impact in the Northeast and Midwest, the decline is in line with a hesitation in builder sentiment as measured by the NAHB/Wells Fargo March Housing Market Index that fell 2 points to 53. Builders express concern that buyers are unable to attain a mortgage because of tight underwriting standards and that buyers continue to expect price concessions and discounts.

Coincident with buyers discount expectations, builders are facing higher costs and reduced availability of lots on which to build the homes and workers to construct them. The squeeze is causing builders to slow construction until new home prices rise, consumers regain confidence and the supply chain for lots, labor and, to a lesser extent, building materials rebuilds.

The underlying conditions for a good, not great, housing rebound remain in place. The economy is adding jobs at a much faster pace than earlier in the recovery, overall growth is more dependably positive, mortgage rates are historically low and there is considerable pent-up demand waiting to be released. Consumers need to regain their confidence in those trends and to readjust their expectations for home prices. The softness in the fourth quarter GDP estimates and the very slow rise in worker pay and household incomes contributed to the current hesitation.

Archives:

2024-03 | 2024-02 | 2024-01 | 2023-12 | 2023-11 | 2023-10 | 2023-09 | 2023-08 | 2023-07 | 2023-06 | 2023-05 | 2023-04 | 2023-03 | 2023-02 | 2023-01 | 2022-12 | 2022-11 | 2022-10 | 2022-08 | 2022-07 | 2022-06 | 2021-09 | 2021-08 | 2021-07 | 2021-06 | 2021-05 | 2021-04 | 2021-03 | 2021-02 | 2021-01 | 2018-02 | 2018-01 | 2017-12 | 2017-11 | 2017-10 | 2017-07 | 2017-06 | 2017-05 | 2017-04 | 2017-03 | 2017-02 | 2016-10 | 2016-09 | 2016-06 | 2016-05 | 2016-04 | 2016-03 | 2016-02 | 2015-03